38+ mortgage payment percentage of income

Lenders prefer you spend 28 or less of your gross monthly. Web This is the percentage of your gross monthly income your pre-tax income before deductions that goes toward minimum debt payments.

Free 8 Sample Income Based Repayment Forms In Pdf Ms Word

The 2836 Rule is the rule-of-thumb for calculating the amount of debt that can be taken on by an individual or household.

. Web The Bottom Line. Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households. Or 45 or less of your after-tax net income.

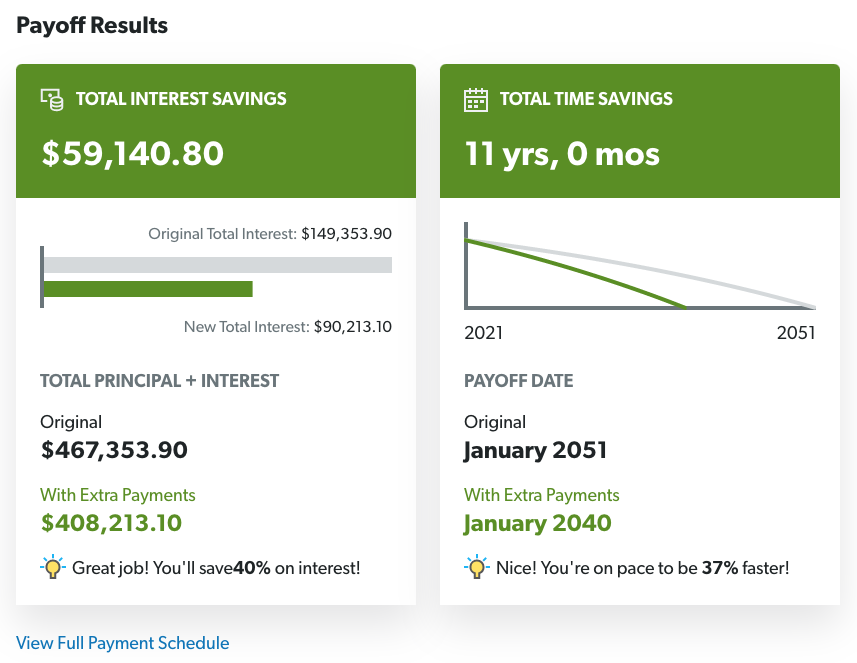

On a 30-year mortgage with a 700 fixed interest rate youll pay 41852669 in interest over the life of your loan. Find A Lender That Offers Great Service. Principal interest taxes and insurance.

Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. This rule says you. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income.

Keep your total monthly debts including your mortgage. Ad Easier Qualification And Low Rates With Government Backed Security. Web Your total interest on a 300000 mortgage.

A 20 down payment is ideal to lower your monthly. See how much house you can afford. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web Front-end only includes your housing payment. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. The 28 rule isnt universal.

In that case NerdWallet recommends an annual pretax income of at least 184656. Mortgage payment as a percentage of income. Web Key Takeaways.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. If you borrowed the same amount. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web States with the highest average mortgage payments relative to average household income No.

Some financial experts recommend other percentage models like the 3545 model. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Lenders want to make sure these expenses dont exceed 36 of your monthly.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad Calculate Your Payment with 0 Down. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

Total monthly mortgage payments are typically made up. Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one. For example if you have 1000 of monthly debt and make 3500 a.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. The 2836 Rule states that a.

Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment.

The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

Keep your mortgage payment at 28 of your gross monthly income or lower. Web For example if you borrowed 270000 and took out a 30-year loan at 39 your principal and interest payment would be 1274. Compare More Than Just Rates.

So taking into account homeowners insurance and property taxes. Web The amount of money you spend upfront to purchase a home. Ad Calculate Your Payment with 0 Down.

Most home loans require a down payment of at least 3. Web Dollar amount of monthly debt you owe divided by dollar amount of your gross monthly income. Web The 3545 Model.

Web 2836 Rule. Your DTI ratio tells.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much To Spend On A Mortgage Based On Salary Experian

Ellijay Ga Real Estate Homes For Sale Homes Com

Here S How To Figure Out How Much Home You Can Afford

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Refinance Now To Improve Your Savings Rate Cash Flow And Overall Wealth

What Percentage Of Income Should Go Toward A Mortgage

What Percentage Of Your Income To Spend On A Mortgage

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Of My Income Should Go Towards A Mortgage Payment

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Affordability Calculator How Much House Can I Afford Zillow

The Income Required To Qualify For A Mortgage The New York Times

U S Median Mortgage Payments And Rents As A Percentage Of Median Income Your Personal Cfo Bourbon Financial Management

What Percentage Of Income Should Go To Mortgage Banks Com

The Minimum Qualifying Income Required To Purchase A House

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com