44+ mortgage interest deduction calculator 2021

Ad Predict Your Mortgage Payments So You Can Be Sure It Fits Your Budget. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

15 Sample Land Contract Forms In Pdf Ms Word

Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

. Web 1250000 Loan Amount Exceeds 750000 Limit x 05 interest rate 62500 Interest Paid But there is a second step now because you cannot deduct all of that interest. 11 2021 at 1144 am. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

AGI gross income adjustments to income. Web The IRS lets you deduct interest paid on your mortgage from your taxes as long as you itemize. However higher limitations 1 million 500000 if married.

Explore Top Rated Information. For tax years before 2018 the interest paid on up to 1 million of acquisition. You can claim a tax deduction for the interest on the first.

Which they can use to calculate whether they should take the deduction. Web Go to Screen 25 Itemized Deductions. As of 2018 youre allowed to deduct the interest on up to 750000.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The IRS places several limits on the amount of interest that you can deduct each year. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Explore Tools Education Resources On What To Expect From Mortgage Application To Closing. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Web Enter your filing status income deductions and credits and we will estimate your total taxes.

Gross income the sum of all the money you. Ad Whether You Are Buying Or Refinancing TD Bank Has Multiple Payment Options For You. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

The input within the program is. Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Web You can calculate your AGI for the year using the following formula.

Average balance of home acquisition debt incurred after December 15 2017. Based on your projected tax withholding for the year we can also estimate your. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before December 16. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web For 2021 tax returns the government has raised the standard deduction to. This portion of the worksheet only appears if you entered a 1 in the 1debt incurred. Enter information for up to 4 loans.

If you put on your tax return a. Web Last Updated. Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

From the left sections select Excess Mortgage Interest.

Mortgage Interest Deduction Tax Calculator Nerdwallet

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Taxable Income Formula Calculator Examples With Excel Template

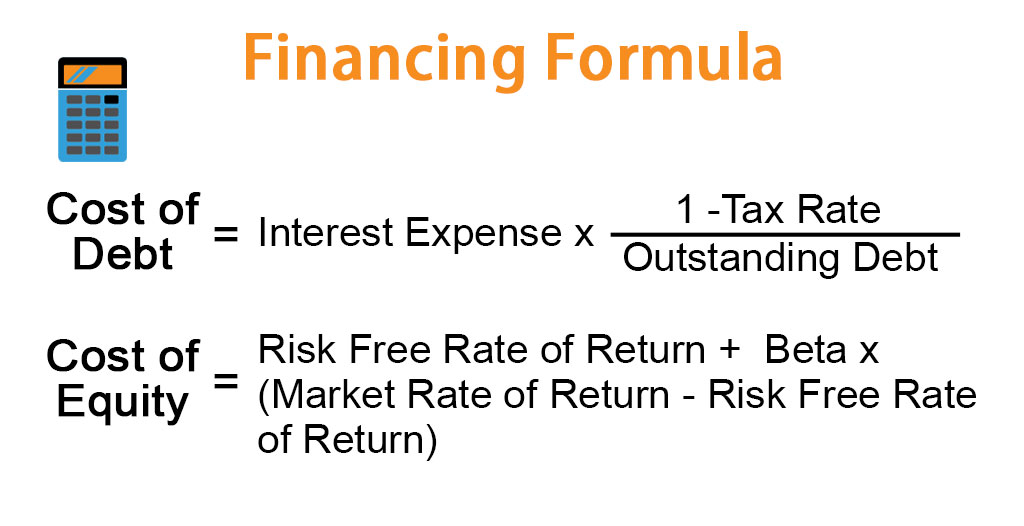

Financing Formula Calculator Example With Excel Template

Home Mortgage Interest Deduction Calculator

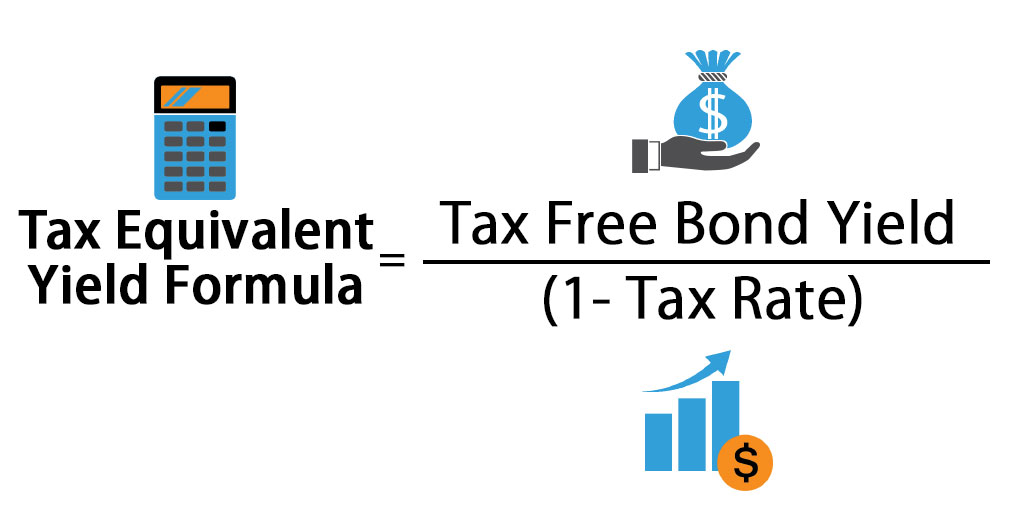

Tax Equivalent Yield Formula Calculator Excel Template

Payroll Tax How To Calculate Payroll Tax With Components And Example

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

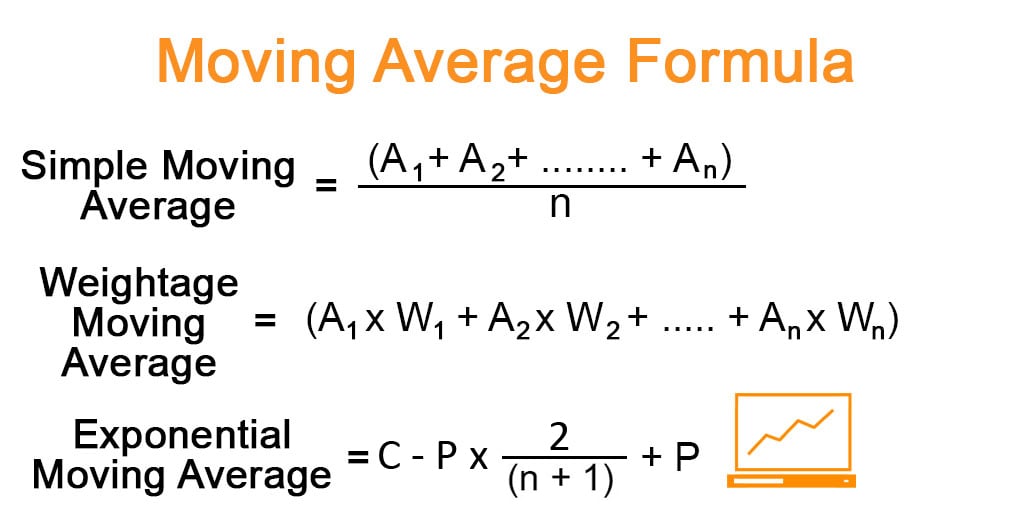

Moving Average Formula Calculator Examples With Excel Template

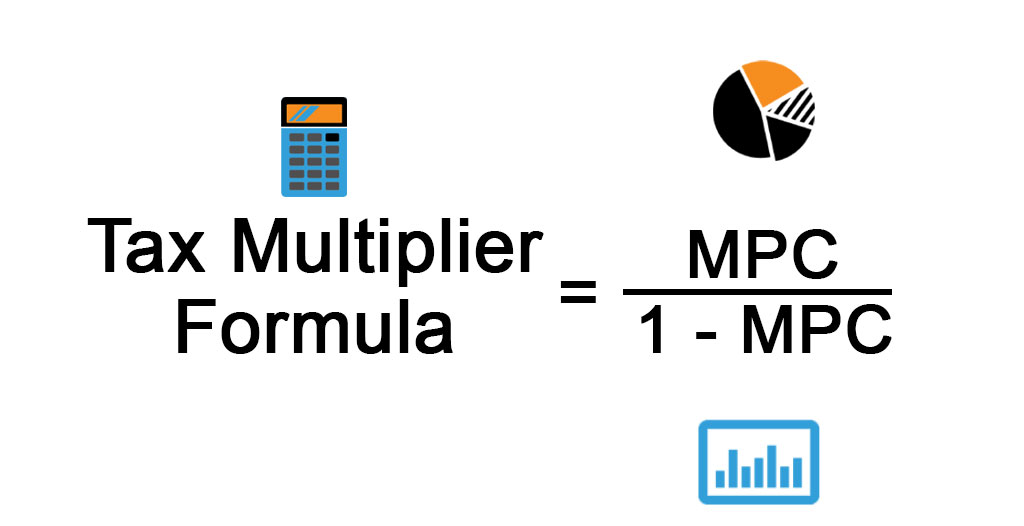

Tax Multiplier Formula Calculator Examples With Excel Template

Mortgage Tax Savings Calculator

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

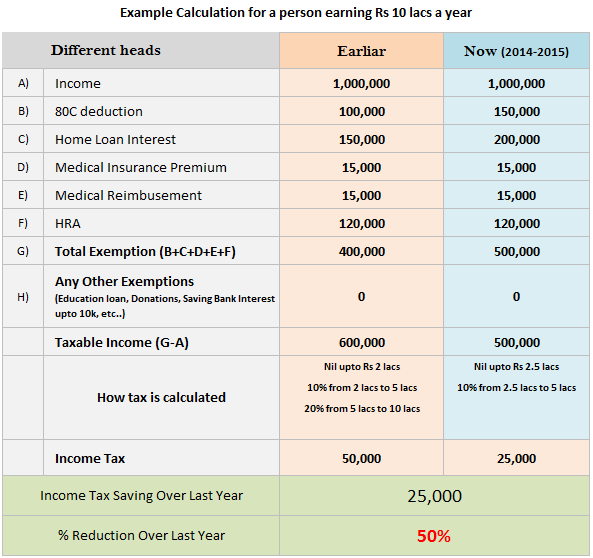

50 Saving In Your Income Tax Due To Budget 2014 Download Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Investment Income Steps On How To Calculate Investment Income